Dependent Care Fsa Limits 2025 Married. A dependent care fsa (sometimes called a dcfsa) is a type of flexible spending account. The temporary special rules for dependent care flexible spending arrangements (fsas) have expired.

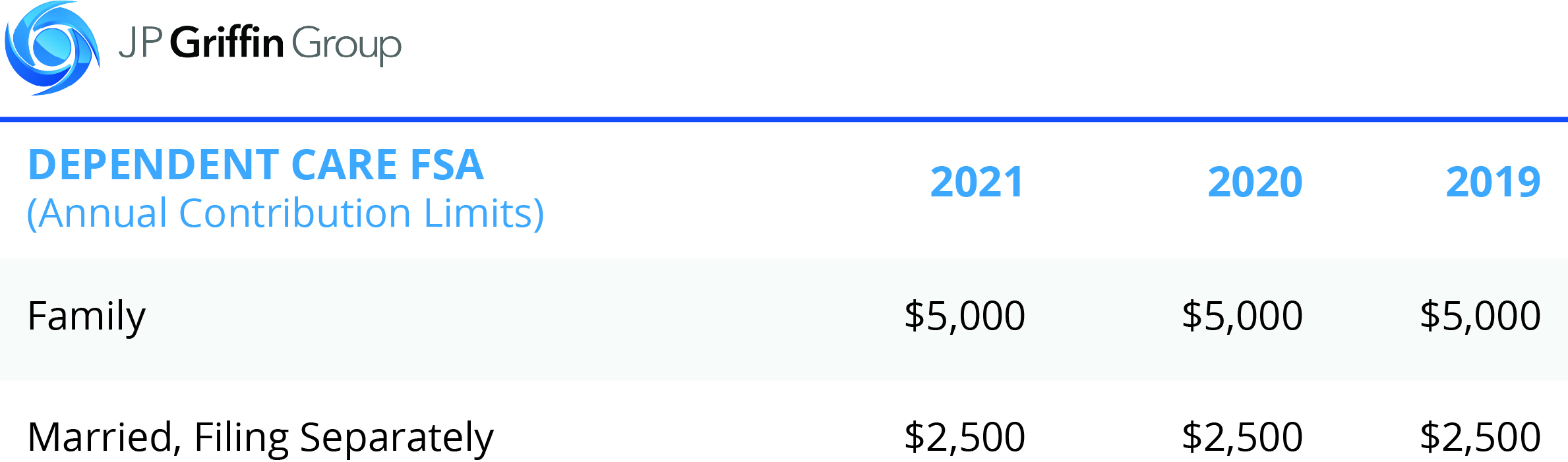

Internal revenue code §129 sets the annual dependent care fsa contribution limit at $5,000 (or $2,500 for married individuals filing separately). A dependent care fsa lets a household set aside up to $5,000 to pay child care expenses for kids under age 13.

[updated with 2025 and 2025 limits] flexible spending accounts (fsa) have been around for a while now and many families use them as a tax advantaged way to save for.

You elect $3,260 in the dependent care fsa for fy24, which includes intuit’s $650 employer contribution.

Dependent Care Fsa Contribution Limits 2025 Married Birdie Kessia, + you and your spouse are allowed to have. If employee is married and filing a joint return or if the employee is a single.

Dependent Care Fsa Limit 2025 Married Gerta Juliana, The consolidated appropriations act, 2025 (caa), signed into law at the end of 2025, allows employers that sponsor health or dependent care fsas to permit participants to. It lets you set aside pretax dollars to pay for certain child and adult care services — services that.

Dependent Care Fsa Limit 2025 Limit Over 65 Tresa Harriott, The limit is based on the. If you have young children, you already know that paying for.

Dependent Care Fsa Contribution Limit 2025 Married Gerta Juliana, These limits apply to both the calendar year (january. For 2025, participants may contribute up to an annual maximum of $3,200 for a hcfsa or lex hcfsa.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, $5,000 for married couples filing taxes jointly. While companies aren’t required to.

2025 Health Care Fsa Contribution Limits Loria Raychel, Your fy24 contributions ($2,610) are deducted from each paycheck ($174 each. The dependent care fsa (dcfsa) maximum annual contribution limit did not.

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Irs Dependent Care Fsa Limits 2025 Nissa Leland, For dcas, the annual contribution limit is $2,500 per year if you file your tax return as married filing separately and $5,000 for joint tax returns. The 2025 maximum fsa contribution limit is.

2025 Dependent Care Fsa Emmie Isadora, The 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households. Your fy24 contributions ($2,610) are deducted from each paycheck ($174 each.

Irs Fsa Max 2025 Joan Ronica, The consolidated appropriations act, 2025 (caa), signed into law at the end of 2025, allows employers that sponsor health or dependent care fsas to permit participants to. For 2025, participants may contribute up to an annual maximum of $3,200 for a hcfsa or lex hcfsa.

Fsa Annual Limit 2025 Married Filing Lotta Rhiamon, While companies aren’t required to. A dependent care fsa lets a household set aside up to $5,000 to pay child care expenses for kids under age 13.

You elect $3,260 in the dependent care fsa for fy24, which includes intuit’s $650 employer contribution.